Germany’s financial prospects are trying up after two grueling years of near-zero progress. The buyer-led revival, although, papers over enduring industrial weak spot for which there’s no fast repair.

Article content

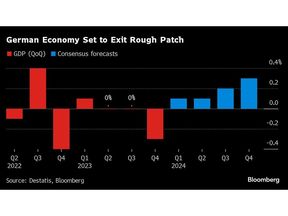

(Bloomberg) — Germany’s economic prospects are looking up after two grueling years of near-zero growth. The consumer-led revival, though, papers over enduring industrial weakness for which there’s no quick fix.

Data this week signaled the fledgling recovery in Europe’s largest economy is gaining momentum — especially in service sectors like tourism and hospitality. The mood among businesses is perking up as confidence builds that a widely anticipated winter recession has, in fact, been avoided.

Advertisement 2

Article content material

Article content material

At the same time as factories stay mired in a droop, the inexperienced shoots are being welcomed throughout the 20-nation euro zone, the place Germany was the first engine of growth earlier than surging power prices and wilting Chinese language demand turned it into the largest laggard.

Politics may additionally profit as rising wages, retreating inflation and the chance of imminent cuts in rates of interest increase the outlook — serving to blunt the attraction of the far-right AfD occasion whose help has surged lately.

“Shoppers are a bit extra sure about developments and are blissful to spend a bit extra,” stated Anja Heimann, an economist at HSBC. However with manufacturing nonetheless on the again foot, “we don’t actually anticipate a powerful pickup in Germany, as a result of trade has such an essential weight in general progress.”

An preliminary verdict on first-quarter gross home product is due Tuesday from Destatis, with the Bundesbank not too long ago reversing an earlier name for contraction to now predict progress, albeit modest. On the again of shrinking output within the earlier interval, rising industrial manufacturing and a greater efficiency by building amid gentle winter climate in all probability buoyed the consequence.

Article content material

Commercial 3

Article content material

That view chimes with economists surveyed by Bloomberg, who estimate a 0.1% advance in GDP. A Bloomberg Economics nowcast, although, nonetheless factors to a slight dip.

What Bloomberg Economics Says…

“The German financial system is on the street to restoration, in accordance with latest survey knowledge. The stronger April studying of the Ifo enterprise local weather index factors to higher-than-expected exercise within the present quarter, primarily pushed by accelerating progress within the companies sector.”

—Martin Ademmer, economist. Click on right here to learn the complete be aware

Regardless of the consequence, there’s a great likelihood this quarter can be stronger. Enterprise expectations measured by the Ifo institute hit a one-year excessive in April, whereas client sentiment gained for a 3rd month because of rising pay expectations, in accordance with GfK.

The renewed perception comes in opposition to a backdrop of moderating inflation, which has slowed to 2.3% from a peak of 11.6%. That pattern is mirrored throughout the area, prompting the European Central Financial institution to pencil in a primary charge lower for June following its barrage of hikes.

Firms reporting first-quarter outcomes this week started to mirror the higher information: Software program maker SAP SE foresees file income progress in its cloud enterprise, whereas Adidas AG boosted its revenue goal.

Commercial 4

Article content material

Tempering the dimensions of Germany’s rebound, nevertheless, is its outsized manufacturing sector, whose malaise is now approaching two years, in accordance with S&P International’s newest ballot of buying managers.

Chemical compounds big BASF SE noticed earnings decline firstly of 2024, with Chief Government Officer Martin Brudermueller saying he can’t “affirm a basic turnaround” in his trade, which has been weighed down by larger gasoline costs and limp overseas demand.

The temper within the flagship auto sector isn’t a lot better. Provider Continental AG fell wanting already low expectations, and CEO Nikolai Setzer warned shareholders Friday of a “sluggish begin to the yr.”

Some are optimistic that producers will finally meet up with different components of the financial system.

Bundesbank President Joachim Nagel stated he’s listening to of “comparatively strong” manufacturing unit orders, whereas Deutsche Financial institution AG analysts are bullish that world progress will help exports within the coming months. The Worldwide Financial Fund not too long ago lifted its projection for world output in 2024 by a contact, to three.2%.

Chancellor Olaf Scholz has additionally struck an optimistic tone, saying “the contribution of German trade to progress, prosperity and employment stays unbroken.”

Commercial 5

Article content material

Whereas it would take time for producers to really feel the advantages of looser financial coverage, exports may gain advantage from firmer world commerce this yr. Certainly, Ifo President Clemens Fuest is puzzled it’s not taking place already.

“We see an enhancing worldwide financial system, however this doesn’t appear to succeed in German manufacturing,” he instructed Bloomberg TV’s Francine Lacqua. “We don’t see the restoration there but. It’ll hopefully be coming however which will take a while.”

Structural worries additionally loom giant. Lowly longer-term GDP forecasts frightened Financial system Minister Robert Habeck when he offered a meager improve to this yr’s projection on Wednesday. The federal government now sees progress of 0.3% — up from 0.2% earlier than.

“We should allow new financial dynamism, strengthen innovation, scale back pointless forms and sort out labor shortages with dedication,” Habeck stated.

That’s proved tough. A latest €3.2 billion ($3.4 billion) tax-relief package deal was diluted throughout prolonged negotiations and deemed by Finance Minister Christian Lindner as solely a primary step towards extra fast financial growth.

What’s extra, Scholz’s three-party coalition might want to discover about €20 billion in financial savings for subsequent yr’s price range to adjust to constitutional borrowing limits. However whereas the ensuing debate might restrain the financial upswing, it gained’t stop it, in accordance with Holger Schmieding, chief economist at Berenberg.

“So long as coverage uncertainty doesn’t worsen, households and companies are prone to step up spending from the latest depressed ranges,” he stated. “The rebound in enterprise and client expectations factors that method.”

—With help from Ben Sills and Kamil Kowalcze.

Article content material